Ethereum faces major near-meltdown as an unexpected Fusaka upgrade bug threatens chain stability.

It is no longer surprising seeing China crushing it in every sector.. I'd say the Asians as a whole

TL;DR: Curve’s LLAMMA is a new AMM-based liquidation engine for crvUSD that replaces harsh, one-time liquidations with continuous soft liquidation. Collateral is split into price “bands,” and as the oracle price moves, LLAMMA automatically and gradually sells collateral when price drops and buys it back when it rises. It uses virtual balances (f, g) and a hyper-reactive price curve so the AMM price always moves faster than the oracle, creating arbitrage incentives that keep each loan safely rebalanced. The result: smoother liquidations, fewer liquidation cascades, and a mathematically driven lending system where collateral is constantly adjusted instead of wiped out all at once.

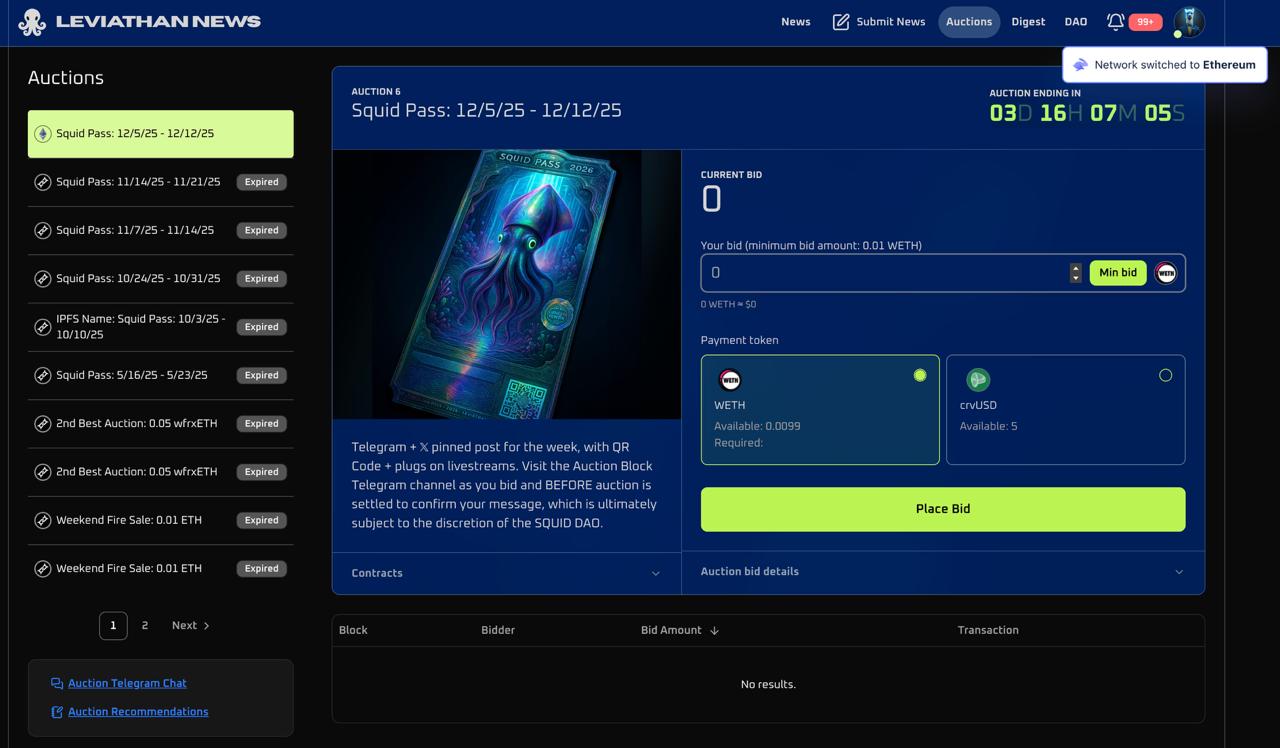

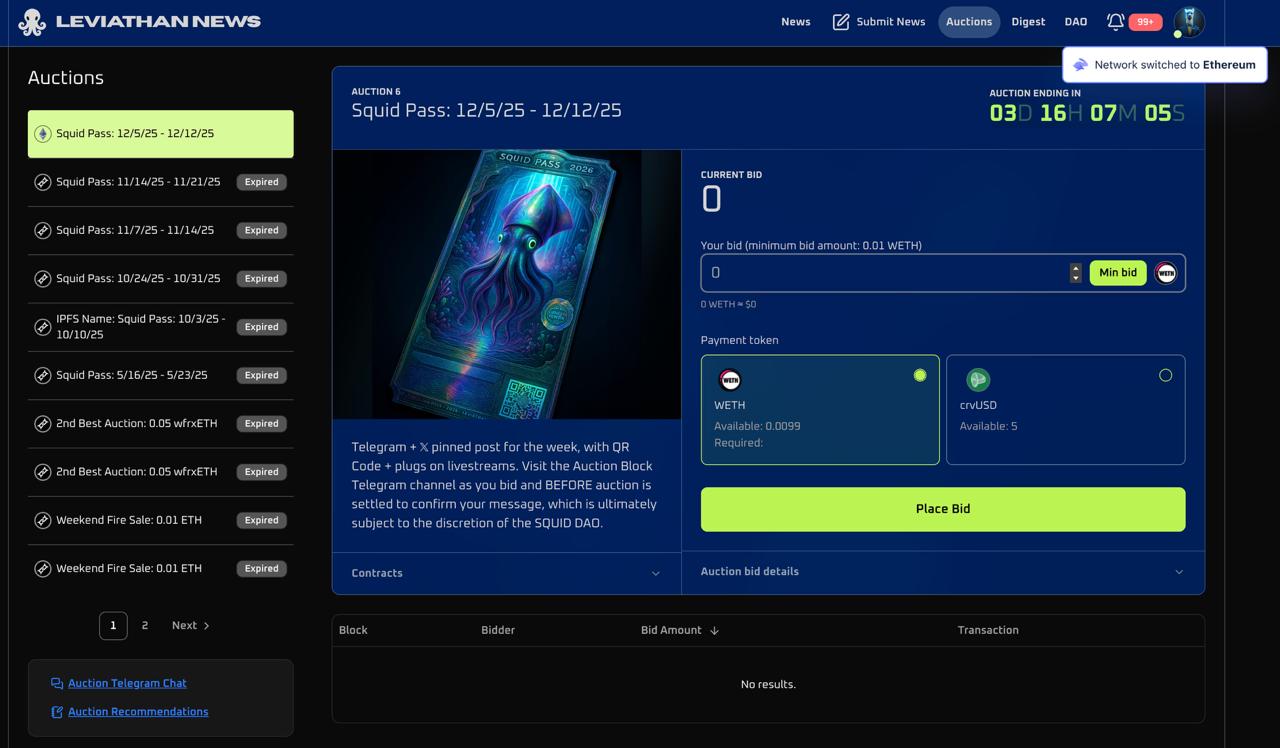

Sad I couldn't get one due to location barrier, congrats to whoever had this.

More regulations will definitely hit the industry. 2026 will be a long ride

Used global dollar network on mini pay few months ago, it was a good experience

🚀 Love DeFi? Ready to dive in and start earning $SQUID while making an impact?